I’ve long believed that hyperinflation is coming to America. The problem is that I don’t know when. Granted, we could see spells of deflation, stagflation, or some combination of the above, so who’s to say precisely what to expect. What I can say is that if you’re not prepared for such events before they strike, you’re going to be in big trouble! This is, in part, a big reason why I continue to prepare myself and my family. And, while I may not be taking all of the right actions, I am continuing to prepare for such an eventuality because I believe it is inevitable. I suggest you do as well.

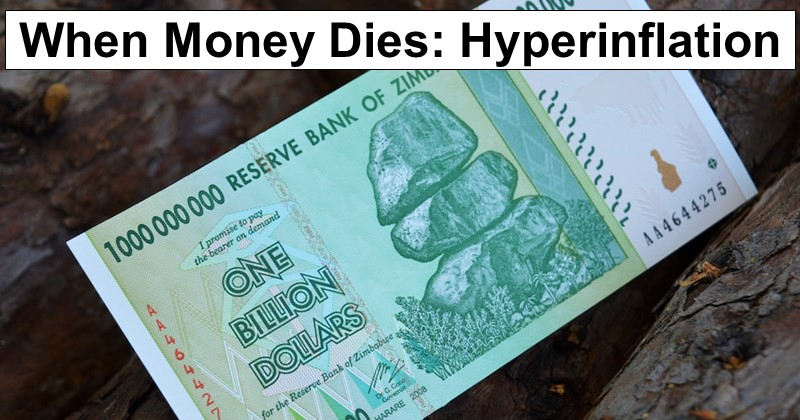

For context, take the time to watch the following 15 minute video summarizing the book When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany by Adam Fergusson, then I’ll offer my thoughts:

Much of what occurred in post-WWI Weimar Germany should make sense, but here’s a handful of reminders:

- Once the monetary snowball begins to roll, it quickly spins out of control. Back then it needed about two years to truly spiral downhill, but I’d suspect that such a catastrophe will happen much faster in America given our already outrageous debt and out of control spending habits. For example, in 1921, a loaf of bread in Germany cost 4 Paper Marks; in 1922 it cost 163 Paper Marks; and in 1923 it cost 200 billion Paper Marks. That’s outrageous! Spend your money wisely now so you’re not forced to spend such sums for a single loaf of bread.

- As you might suspect, nobody wanted German Paper Marks after the war, so those who held them hoping things might get better were out of luck; everyone either wanted foreign currency or gold. While I believe in having a rainy day fund, ensure it’s diversified beyond paper cash and money in the bank.

- The government, in an attempt to keep the populace from uprising, continued to print money to keep them employed, which only made the money problem worse. Don’t expect the government or any powers that be to fix anything for you. Ever. Take care of yourself.

- Gold vastly outperformed the stock market and corporate dividends; he didn’t say how silver performed. I’m remiss to offer financial advice, so I merely suggest you reread point two above.

- Theft was rampant. Need I say more? Okay, I will. Sadly, people stole everything of value; not just food, but any raw materials from anywhere they could get it. We’ll see a skyrocketing of catalytic converter theft, copper wire theft, and so much more that most won’t see it coming. And we’ll see plenty of violence as a result. Keep your valuables out of sight! Have backups. Be on guard.

- Government became even more authoritarian over their own population. They suspended parts of their Constitution, seized foreign currency and gold from their own citizens, and limited rights to freedom of speech and more. Who wants to guess what America will be like during hyperinflation? It’s going to be a mess; hide your stuff well.

Several interesting points that I hadn’t considered stand out, too:

- The jobs you might expect to do well (doctors, lawyers, government jobs) salaries didn’t keep up with inflation like, believe it or not, union jobs.

- Farmers made out among the best because, much like those who owned certain factories, they were closest to the most necessary supplies people needed–in this case, food–which meant they could set prices as they saw fit and could, therefore, spend money before others did. My guess is that it won’t work out like this because of government intervention and rampant crime. But, because most farms are large corporations, who knows how this might play out. Have plenty of food stockpiled.

- You’ll want to watch the video, but typically those who held mortgages tended to do well because they were able to pay off what was once a large debt relatively easily. The problem is that some of these mortgages were “re-evaluated” which screwed the mortgage holders in favor of the banks. (At least, that’s my take.) Thus, don’t wish for MORE inflation in hopes of paying off large debts.

- This one really stood out: Foreign students were able to purchase rows of German houses using only the allowances they received from their parents. I don’t know how true this is or whether it ended up being worthwhile for the students, but this is something which is only possible for those who plan ahead.

- The rich, as usual, made out better than the working class in many ways, one of which centered around how they paid taxes. Basically, the rich deferred tax payments which resulted in a lesser tax burden due to the value of money between the time they incurred those taxes and when they actually had to pay them.

- Good money chased out bad money; typically, it’s the other way around, but apparently the farmers eventually refused to accept the bad Paper Mark, which from what I gather, played a hand in ending inflation.

- Listen to the end of the video, too. He points out how a sack of potatoes was worth more than the family silver. And how a side of pork was worth more than a grand piano. This should remind you of your true priorities.

How did hyperinflation end? Apparently, the German central bank just declared it over. They issued new currency and somehow everyone agreed, though foreign countries (who still demanded their war debts be paid) seized assets, like gold mines and other raw materials. I don’t see foreigners seizing anything of value here in America, but I absolutely see our own government doing so and possibly many corporations.

So, how might this play out in America? Well, I don’t see the government or Federal Reserve waiting years to institute a new currency or, wait for it…a digital currency, but I don’t see them instituting something new 48 hours later, either.

Why? Because people need to BEG for it. And that will likely take months. Then, when we’ve had enough and everyone has sucked in their belts a few notches, they’ll reluctantly offer their solution: Fed Coin or whatever. The populace will be grateful. We’ll all go back to work, hold hands, and sing songs. We’ll even stop slinging insults at each other over the internet. And I’ll finally catch Santa Clause shimmying his way down my chimney. 🙂

Leave a Reply